Getting My Pacific Prime To Work

Your agent is an insurance policy specialist with the knowledge to guide you with the insurance coverage procedure and help you find the most effective insurance defense for you and the people and points you respect most. This post is for educational and tip objectives just. If the plan protection descriptions in this short article problem with the language in the plan, the language in the policy uses.

Policyholder's deaths can likewise be backups, particularly when they are thought about to be a wrongful death, in addition to residential or commercial property damage and/or destruction. Because of the uncertainty of said losses, they are identified as contingencies. The insured person or life pays a premium in order to receive the benefits guaranteed by the insurance provider.

Your home insurance policy can assist you cover the damages to your home and manage the expense of restoring or repairs. Often, you can additionally have insurance coverage for things or valuables in your house, which you can after that purchase replacements for with the money the insurer offers you. In case of a regrettable or wrongful fatality of a single income earner, a family members's economic loss can potentially be covered by specific insurance policy plans.

3 Easy Facts About Pacific Prime Described

There are various insurance coverage intends that consist of cost savings and/or financial investment systems along with routine coverage. These can assist with building cost savings and riches for future generations through normal or repeating financial investments. Insurance policy can aid your household maintain their requirement of living in case you are not there in the future.

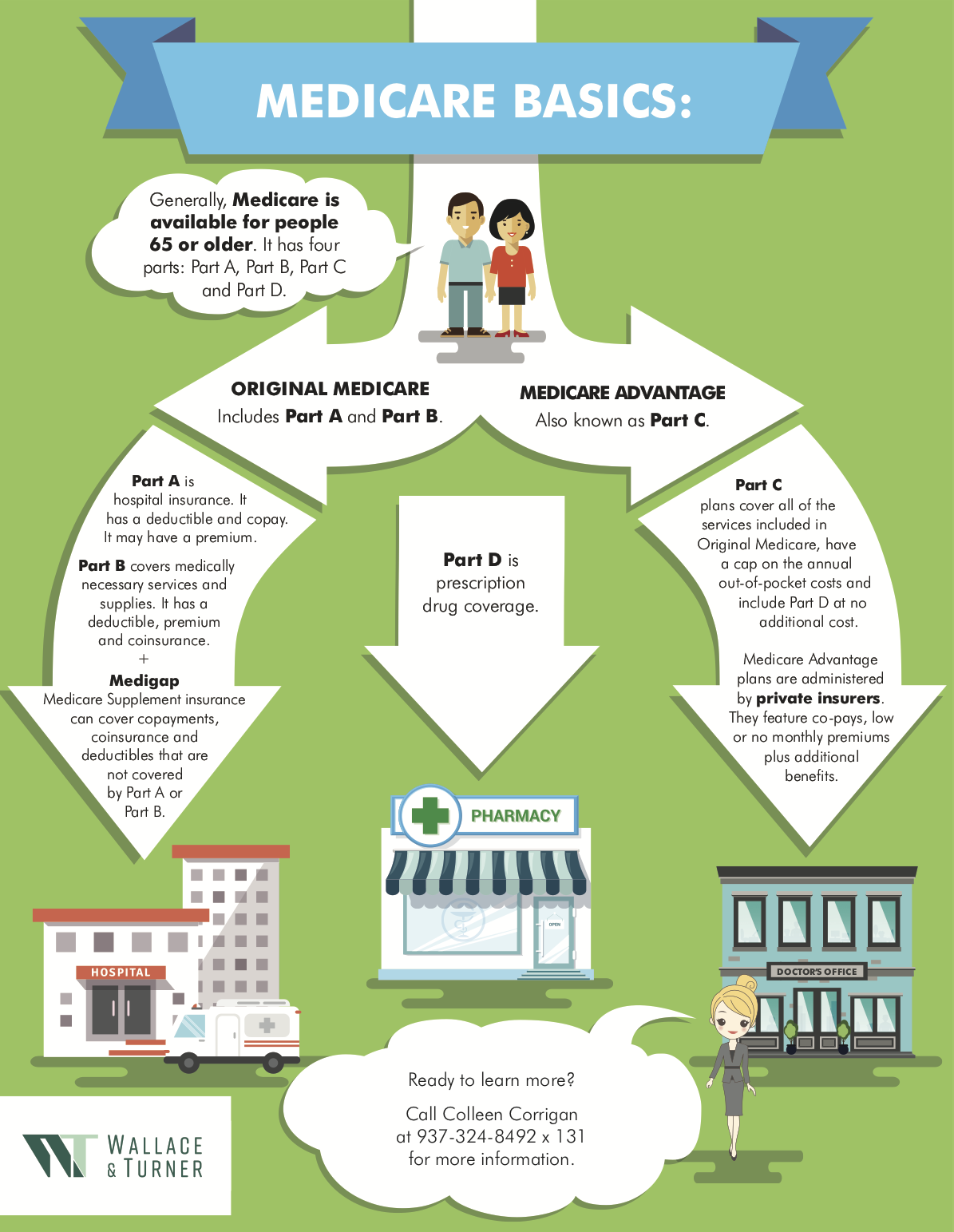

The most standard type for this sort of insurance coverage, life insurance policy, is term insurance policy. Life insurance coverage in general assists your family members end up being protected financially with a payment quantity that is given up the event of your, or the plan holder's, death during a specific plan period. Youngster Strategies This kind of insurance is generally a financial savings instrument that aids with generating funds when kids visit this page reach certain ages for going after college.

Home Insurance coverage This type of insurance covers home damages in the occurrences of accidents, natural tragedies, and problems, together with other similar occasions. international travel insurance. If you are aiming to seek compensation for accidents that have actually occurred and you are battling to find out the proper course for you, get to out to us at Duffy & Duffy Law Firm

The smart Trick of Pacific Prime That Nobody is Discussing

At our regulation company, we understand that you are going through a whole lot, and we recognize that if you are coming to us that you have actually been with a whole lot. https://www.openlearning.com/u/freddysmith-sba6sp/. Due to the fact that of that, we use you a free consultation to go over your concerns and see exactly how we can best help you

Due to the fact that of the COVID pandemic, court systems have actually been closed, which negatively impacts auto accident situations in a tremendous method. Once more, we are here to help you! We proudly serve the people of Suffolk Area and Nassau County.

An insurance coverage is a lawful agreement between the insurance provider (the insurance firm) and the person(s), service, or entity being guaranteed (the insured). Reviewing your plan helps you verify that the plan fulfills your needs and that you understand your and the insurance provider's obligations if a loss takes place. Lots of insureds buy a policy without understanding what is covered, the exclusions that eliminate protection, and the problems that need to be met in order for insurance coverage to apply when a loss happens.

It recognizes who is the guaranteed, what dangers or home are covered, the policy limits, and the plan period (i.e. time the plan is in pressure). The Declarations Page of a life insurance coverage policy will certainly include the name of the person insured and the face quantity of the life insurance coverage plan (e.g.

This is a recap of the major guarantees of the insurance coverage firm and specifies what is covered.

The 5-Second Trick For Pacific Prime

Life insurance policy policies are typically all-risk plans. https://pastebin.com/u/pacificpr1me. The three major kinds of Exemptions are: Left out risks or causes of lossExcluded lossesExcluded propertyTypical instances of left out hazards under a homeowners policy are.